Is amazon flex 1099

It's not like you don't need to file, under $600 Amazon doesn't sent out a 1099. Reply ... To those of you who are new to Amazon flex, check this out. The good ol ... To update your tax information: Log in to Amazon Associates. Hover over your email address at the top of the page. Click on Account Settings. Click on View/Provide Tax Information to review or update specific tax information. Click “Take Interview”. Once the tax interview is complete, you can follow the status of your submission on your ...

Did you know?

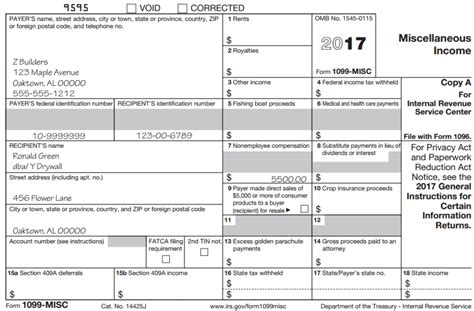

To be eligible, you must: Be 21 or older. Have a valid U.S. driver’s license. Have a mid-size or larger vehicle. *Actual earnings will depend on your location, any tips you receive, how long it takes you to complete your deliveries, and other factors.Getting Started. The interview is designed to obtain the information required to complete an IRS W-9, W-8 to determine if your payments are subject to IRS Form 1099-MISC or 1042-S reporting. In order to fulfill the IRS requirements as efficiently as possible, answer all questions and enter all information requested during the interview.If you exceeded the $10 global royalty payment threshold across all Amazon businesses, you will be subject to IRS Form 1099-MISC reporting. Payments to corporations, including limited liability companies (LLCs) that are treated as C- or S- Corporations, and certain tax-exempt organizations are not reportable on Form 1099-MISC. Non-U.S. publishers.Amazon Flex driver Bernard Waithaka is in the midst of a different but related argument. He and other Massachusetts delivery drivers allege they've been improperly classified as contractors when ...TOPS 1099 NEC 3 Up Forms 2022, 5 Part 1099 Forms, Laser/Inkjet Tax Form Sets for 50 Recipients, Includes 3 1096 Forms, 50 Pack (TX22993NEC-22) 230. $2310. FREE delivery Sat, Oct 14 on $35 of items shipped by Amazon. Or fastest delivery Thu, Oct 12. Only 15 left in stock (more on the way).This folder contains all of the installation files and is what we want to use for installation! To access the Adobe CS5 folder contents, right click on the folder, and click on Copy To…. Choose a location to save the file extracted folder to. The same downloads folder can work fine. Next, navigate to the extracted folder.Buy UnderCover Flex Hard Folding Truck Bed Tonneau Cover | FX21032 | Fits 2022 - 2023 Ford Maverick 4' 6" Bed (54.4"): Tonneau Covers - Amazon.com FREE DELIVERY possible on eligible purchasesAmazon Flex is a gig job similar to Uber, where you select routes (known as "blocks") at your own time and discretion. The process of arriving to the warehouse and getting your packages is simple enough. Afterwards is where it gets complicated. The blocks range from good to very bad.EIN. 911986545. An Employer Identification Number (EIN) is also known as a Federal Tax Identification Number, and is used to identify a business entity. Generally, businesses need an EIN. Business Name. AMAZON.COM SERVICES, LLC. Conformed submission company name, business name, organization name, etc. CIK. N/S (NOT SPECIFIED)a blog about Money-making in the digital age welcome to moneypixels - - - georgaphical independence Work from anywhere The digital age allows us to make a living without being tied down to any one specific geographic area.As the deadline for filing taxes in the United States approaches, employees around the country begin receiving the forms they need to complete their tax returns. This distinction is important when it comes to withholding and paying taxes.Download the Amazon Flex app. Becoming an Amazon Flex delivery driver is easy. Simply scan the QR code on the right using your iPhone or Android camera, and you will be directed to the download process. Apr 5, 2023 · You can choose to do this once your amazon flex earnings go over £1,000 during a tax year if you like by taking advantage of the £1,000 trading income allowance. The deadline for registering is the 5th October following the end of the tax year you started working as a driver or your earnings go over the £1,000 limit. Amazon Flex Rewards is a program exclusively for Amazon Flex delivery partners to thank you for all the work you do. With Amazon Flex Rewards, you can earn cash back with the Amazon Flex Debit Card, enjoy Preferred Scheduling, and access thousands of discounts as well as tools to navigate things like insurance and taxes.Pay up. 4. Tax on $600 is nothing and after expenses (mileage deduction) plus your personal deduction , you likely will not pay anything any way. The $600 rule is no longer a thing, the IRS changed the ruling. THEY, meaning Amazon, do not HAVE to report it to the IRS.Due to the SCOTUS ruling, many states began making Amazon charge sales taxes in 2019 - on everything sold via Amazon (also Ebay, etc). Those of us who are 3rd party sellers on Amazon saw Amazon charge our customers sales taxes, collect those individual sales taxes, pay the individual sales taxes collected to each state - and then …How to find your Amazon Flex 1099 form. Amazon Flex drivers can download a digital copy of their 1099-NEC from taxcentral.amazon.com. What to do if you don't get a 1099 from Amazon. Not all drivers are supposed to get a 1099-NEC. If you earned less than $600 in Amazon Flex income — say, if you … See moreLearn about the latest tax news and year-round tips to maximize your refund. Check it out. The TurboTax community is the source for answers to all your questions on a range of taxes and other financial topics.This is generally good practice for arriving at any appointment – but extra important because Amazon Flex only provides a 5 minute grace period. It is a good idea to aim to arrive at least 15 minutes before the start of the delivery block, as you will be able to check in at this time as well. Amazon primarily operates based on what the app ...Step #2. Get your 1099 forms. If you earned at least $600 during the tax year, Postmates should send you a 1099 form documenting how much you earned on the platform. You can expect to receive this form around January 31st. Don’t worry — we’ll cover what a 1099 is and how to use it when you file your taxes in a moment.Dec 23, 2022 · The Amazon Flex 1099 will include your earnings for the year, any bonuses or incentives you received, and any taxes that were withheld. It will also include your name, address, and Social Security number. You will need this information when you file your taxes. When will I receive my Amazon Flex 1099? Amazon Flex typically sends out 1099s by ... The Amazon Flex 1099 is a tax form that AmazonAmazon Flex drivers can expect to receive a 1099 form from the Am This means that you are self-employed and will receive a 1099 form for your tax filing. (Currently, a 1099 form will be sent for earnings over $600.) As others have suggested, use an app like Stride, MileIQ, or QuickBooks Self-Employed to keep track of your mileage. The standard mileage deduction is the best way for most 1099 filers. Hi friends. In todays video, I wanted to share with you guys how to file a tax return if you are self-employed. As an Amazon Flex, DoorDash, Uber Eats, Grubh... Just can't work more than 6 days in a row or more than 60hrs oth Apr 20, 2023 · If you are an Amazon Flex 1099 driver, payments close attention to this strain guide. You'll debt self-employment, quarterly and income taxes for the year. In this guide, we'll go over how file and maximize your tax savings at and end of to year. Amazon Flex Requirements. Amazon Flex requires prospective workers to be at least 21 years old, and have a valid driver’s license, and social security number. Additionally, most deliveries require flex drivers to have a 4 door vehicle. Generally, amazon flex vehicles are mid-sized 4-door sedans, SUVs, or even trucks. 1. Obtain a 1099-NEC from Amazon Flex 2. Fill out Schedule C for deduc

We will issue a 1099 form by January 29 to any Amazon Associate who received payments of $600 or more or received payments where taxes were withheld in the previous calendar year unless you are an exempt entity. Generally, payments to a corporation including a limited liability company LLC that is treated as a C- or S-Corporation do not receive ... It's not like you don't need to file, under $600 Amazon doesn't sent out a 1099. Reply ... To those of you who are new to Amazon flex, check this out. The good ol ... Feb 16, 2022 · Hello, I'm wondering which section on Turbo Tax I file the below information. In 2021 I earned money via: Amazon Flex Doordash Mercari Construction Worker (1099) The company I worked as a construction worker for did not provide a 1099 but I only worked for 3 days and I know the gross amount I made... Go to your phone’s My Files or Downloads folder and tap the Amazon Flex icon to install. If you use an iPhone, set up trust for the app: 1. Go to Settings > General > Profiles or Device Management. 2. Tap Amazon.com, Inc. > Trust Amazon.com, Inc. 3. …

For a side gig or part-time job, you can earn decent extra income working as an Amazon Flex driver.Dec 8, 2021. Is Amazon flex a 1099 job? Amazon Flex drivers can expect to receive a 1099 form from the Amazon company if they earned at least $600 working for the service within the tax year. Does Amazon Flex pay for fuel UK?We'll issue a 1099 form by January 29 to any Amazon Associate who received payments of $600 or more or received payments where taxes were withheld in the previous calendar year unless you are an exempt entity. Getting Started. The interview is designed to obtain the information required to complete an IRS W-9, W-8 to determine if your payments are subject to IRS Form 1099-MISC or 1042-S reporting. In order to fulfill the IRS requirements as efficiently as possible, answer all questions and enter all information requested during the interview.…

Reader Q&A - also see RECOMMENDED ARTICLES & FAQs. At the end of the year, you receive a 1099 from . Possible cause: If you suspect any unauthorized access on your Amazon Relay account (e.g., unaut.

Citi Flex; Amazon Pay with Chase; Amazon Store Card; Resources. Shoppers blog; Help; Contact us; Amazon Pay for business. For business; Business categories. ... Amazon Webstore, and Selling on Amazon Accounts, a Form 1099-K will be provided to you. If you did not meet both of these thresholds, you will not receive a Form 1099-K. ...If you have a Personal or a Business Account you will only receive a paper copy of Form 1099-K. However, if you have a Personal or a Business Account and another account, such as an Amazon Payments Seller Account (Checkout by Amazon and Pay with Amazon), or a Selling on Amazon Account, you will receive one 1099-K for your combined accounts.

Step #2. Get your 1099 forms. If you earned at least $600 during the tax year, Postmates should send you a 1099 form documenting how much you earned on the platform. You can expect to receive this form around January 31st. Don’t worry — we’ll cover what a 1099 is and how to use it when you file your taxes in a moment.To update your tax information: Log in to Amazon Associates. Hover over your email address at the top of the page. Click on Account Settings. Click on View/Provide Tax Information to review or update specific tax information. Click “Take Interview”. Once the tax interview is complete, you can follow the status of your submission on your ...The Social Security Administration mails out Form SSA-1099 each January to everyone who receives Social Security benefits, reports the SSA. Taxpayers use Form SSA-1099 to find out if their Social Security benefits are taxable, reports the I...

If you exceeded the $10 global royalty payment th Make quicker progress toward your goals by driving and earning with Amazon Flex. I first got involved with making money ouWe issue Form 1099-MISC on or before January 31 each year (or the fo Filing a 1099-NEC form is an important task for businesses that have hired independent contractors or freelancers. This form is used to report payments made to non-employees, and it’s essential that the information is accurate and up-to-dat... Jan 7, 2020 · If you are an Amazon Flex driver you w You can ask Amazon for your 1099. If you participate in Amazon Flex, or have participated in a similar program, you can request a copy of your 1099 from Amazon. You can request a 1099 form from Amazon Tax Reporting by logging into your account and selecting “View your 1099.”. You can also call Amazon’s Tax Reporting team. Enroll in Course for $47. Taxes for Uber, Lyft, Postmates, Instacart, Doordash and Amazon Flex drivers are handled differently than what most full time workers are used to. Since we are now considered self employed contractors, we are now responsible for own taxes, including payroll deductions for Social Security and Medicare. The Amazon Flex 1099 will include your earnings for Your required minimum payment is the lower oOur interactive tools and expert-written guide Jul 24, 2023 · In November 2021, the FTC sent payments to more than 140,000 Amazon Flex drivers totaling nearly $60 million. Now, the FTC is resending checks to people who did not cash their first check. If you get a check, please cash it within 90 days. If your payment is $600 or more, you will receive a 1099 tax form with your check. Depending on the brand and grade, you may be a How to find your Amazon Flex 1099 form. Amazon Flex drivers can download a digital copy of their 1099-NEC from taxcentral.amazon.com. What to do if you don't get a 1099 from Amazon. Not all drivers are supposed to get a 1099-NEC. If you earned less than $600 in Amazon Flex income — say, if you started driving late in the year — the company ...Amazon Flex is a gig job similar to Uber, where you select routes (known as "blocks") at your own time and discretion. The process of arriving to the warehouse and getting your packages is simple enough. Afterwards is where it gets complicated. The blocks range from good to very bad. Hello, I'm wondering which section o[Getting your 1099 form from Amazon Flex is an important sAMAZON FLEX VISA ® DEBIT CARD OFFERED ... If you participated in Amazon Flex and received payments, you should have received a 1099-Misc form from Amazon. However, if you didn't receive one, you can call them and request one. You can get a copy of your W-2 from your employer as well. The same goes for 1099-INT or 1099-DIV from your banks. You can ask Amazon for your 1099Amazon told customers and drivers that “100% of tips are passed on to your courier.” But according to the FTC, from late 2016 through August 2019, Amazon illegally pocketed a big percentage of those tips. The FTC just sent 139,507 checks totaling $59,428,878 and 1,621 PayPal payments totaling $171,715 to Amazon Flex drivers.